US importers are drowning in a flood of extreme tariffs on Chinese goods. With rates skyrocketing to 145% or even 245%, businesses face impossible choices. Many won’t survive without a strategy shift.

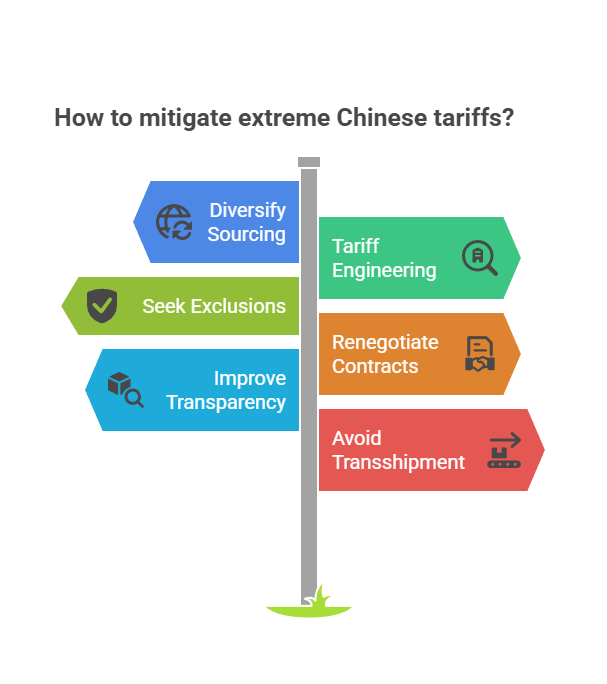

US importers can mitigate extreme Chinese tariffs through: diversifying sourcing, legitimate tariff engineering, seeking exclusions, renegotiating supplier contracts, and improving supply chain transparency. Avoid risky transshipment due to severe new penalties including potential jail time.

These extreme tariffs stem from intensified US-China trade tensions, with dramatic escalation in early 2025. Let’s break down what’s happening and explore practical solutions for your business.

Understanding the Tariff Tsunami: Just How High Are the Duties Now?

The tariffs hitting Chinese imports aren’t just high – they’re unprecedented. My customers are shocked when they see the actual numbers. Many face total duties that make their entire business model unworkable overnight.

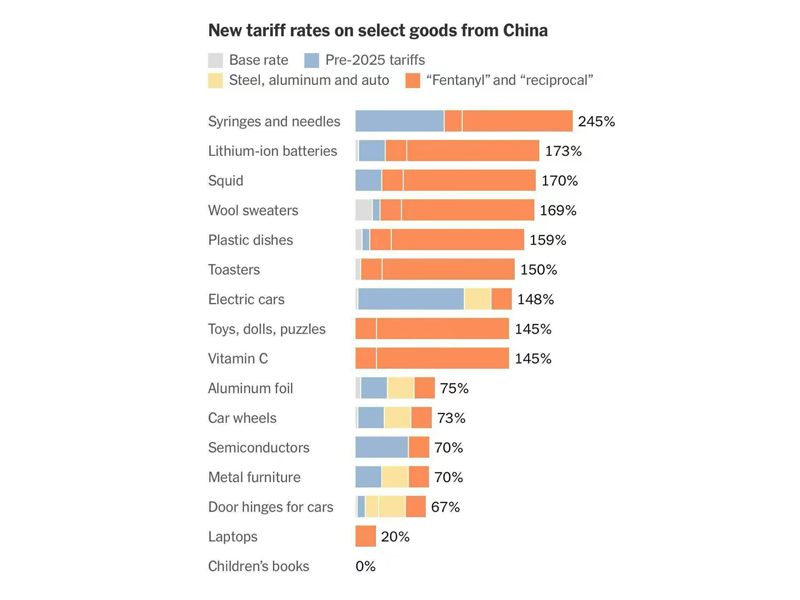

Current tariffs represent a rapid escalation beginning in early 2025. Rates have reached 145% broadly, with selective increases to 245% on certain products. These tariffs stack in layers, creating a complex structure you need to understand.

What makes this particularly challenging? The complex, layered nature of these tariffs. These aren’t simple percentages – they stack on top of each other, multiplying your costs.

The Tariff Timeline Breakdown

Based on reports from February to April 2025, here’s how quickly things escalated:

| Date (Approx.) | Action By | Tariff Details | Stated Reason |

|---|---|---|---|

| Pre-Feb 2025 | US | Existing tariffs (~25% Section 301) | Previous trade disputes |

| Feb 4, 2025 | US | +10% additional tariff on China | "Reciprocal" action |

| Feb 10, 2025 | China | Retaliates with 10-15% on US goods | Retaliation |

| Mar 4, 2025 | US | Implements +10% on China | Fentanyl issue cited |

| Apr 3, 2025 | US | +34% "Reciprocal Tariff" on China | Retaliation |

| Apr 9, 2025 | US | Another +50% additional tariff | Escalation |

| Apr 11, 2025 | US | White House clarifies total rate is 145% | Clarification |

| Apr 15, 2025 | US | Selective increases to 245% on specific items | Targeted action |

This rapid piling-on created a situation where importers face multiple layers of duties:

- Base Rate

- Plus Section 301

- Plus IEEPA

- Plus Reciprocal tariffs

- Often exceeding 150% total

Real-world example: A glass bottle that previously had a 5% base duty plus 25% Section 301 tariff (30% total) might now face the full 145% rate – nearly quintupling your landed cost.

Your next step: Check your product’s specific HTS code at the USITC Tariff Database to determine your exact current rate.

Transshipment Through Third Countries: Could This Be a Solution?

With tariffs this extreme, many importers ask me about transshipment – routing goods through other countries to change their "country of origin."

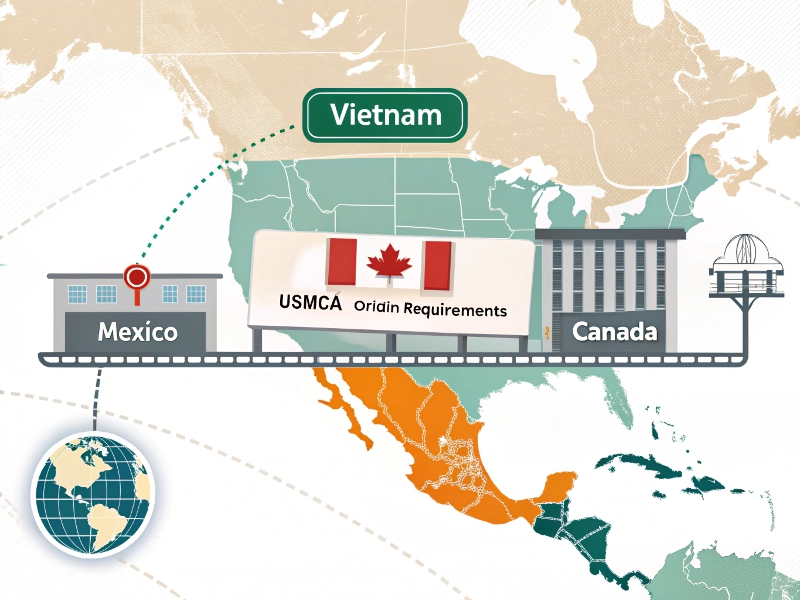

Transshipment means routing Chinese goods through a third country like Vietnam, Mexico, or Malaysia to change the "country of origin" and avoid China-specific tariffs. Warning: This carries significant legal risks unless genuine "substantial transformation" occurs in the transit country.

In theory, the process works like this:

- Goods ship from China to a third country

- Some operations are performed, containers swapped, new documents created

- Goods ship to the US under the new country’s origin

The potential benefit is clear – paying lower tariffs applicable to the intermediate country instead of the punishing China rates. For example, goods from Mexico under USMCA might face zero tariffs if they qualify.

Critical warning: This approach must involve legitimate transformation of the goods, not just paperwork changes. Simple repackaging or minimal processing likely won’t qualify legally.

Your next step: Before considering transshipment, consult with a licensed customs attorney who can explain the specific legal requirements and risks for your product.

Which Countries Are Used for Transshipment, and What Do They Require?

Different countries have varying requirements to legally change a product’s origin. Common transit hubs include Vietnam, Mexico, Canada, and Malaysia.

Each transit country has specific legal requirements. Vietnam requires meeting minimum value-add rules. Mexico and Canada have strict USMCA origin requirements. Simply changing paperwork or minimal repackaging is not enough for legal origin changes.

Key differences between potential transit countries:

| Feature | Vietnam | Mexico | Canada |

|---|---|---|---|

| Process | Import, potential assembly/repacking, export | Import, substantial processing/assembly, export | Import, warehousing, deep processing, export |

| Key Laws | Vietnam Customs Law, FTZ Policies | Mexico Customs Law, USMCA | Canada Customs Law, USMCA |

| Origin Goal | Meet minimum value-add rules | Meet strict USMCA origin rules | Meet strict USMCA/Canadian origin rules |

| US Benefit | Avoid China Tariffs | Avoid China Tariffs + Potential USMCA Duty-Free | Avoid China Tariffs + Potential USMCA Duty-Free |

| Reported Issues | High US scrutiny | Increased origin audits | USMCA compliance checks |

The crucial element across all scenarios is "substantial transformation." This legal concept means the product must genuinely change in character, use, or name through processing in the transit country.

Industry example: Simply moving bottles through a warehouse in Vietnam and changing labels wouldn’t qualify. However, importing raw materials to manufacture the bottles in Mexico might – but you’d need extensive documentation.

Your next step: If considering this route, research the specific "substantial transformation" requirements for your product category in your chosen transit country.

Is Transshipment Still Viable Given New US Enforcement?

This is where importers need a serious wake-up call. The enforcement landscape has completely transformed.

Transshipment has become extremely risky. New legislation reportedly classifies tariff fraud as a federal felony with penalties up to 20 years imprisonment. A new verification system requires detailed supply chain data, with potential 300% fines on evaded duties and 10-year profit clawbacks.

The enforcement changes include:

-

Anti-Third Country Transshipment Act: This reported legislation makes "Tariff Fraud" a federal felony. Key impacts:

- Executives could face up to 20 years in prison

- Joint liability where one company’s violation triggers penalties for an entire industry

- Criminal rather than just civil penalties

-

New Origin Verification System: Active reportedly from April 15th, requiring:

- Detailed supply chain data for high-risk goods

- Special scrutiny for Vietnam, Thailand, Malaysia, Mexico, and Indonesia

- Compliance costs exceeding $5,000 per shipment

-

Documentation Requirements: You may need to provide:

- Production process flowcharts

- Raw material purchase invoices

- Factory energy usage details

- Complete traceability documentation

-

"Every Shipment Check": Intensive verification targeting specific goods/countries.

The penalties would devastate most businesses:

- 300% fine on evaded duties

- 10-year profit clawback

- Account freezes

- Potential seizure of goods

Additionally, the US is pressuring transit countries to crack down internally on transshipment schemes.

Your next step: Evaluate whether any potential tariff savings are worth these severe risks. Contact your trade compliance team or consultant for a risk assessment specific to your situation.

What Does "Substantial Transformation" Really Take to Be Compliant?

Given these risks, understanding what constitutes legal compliance is crucial if you still consider third-country processing.

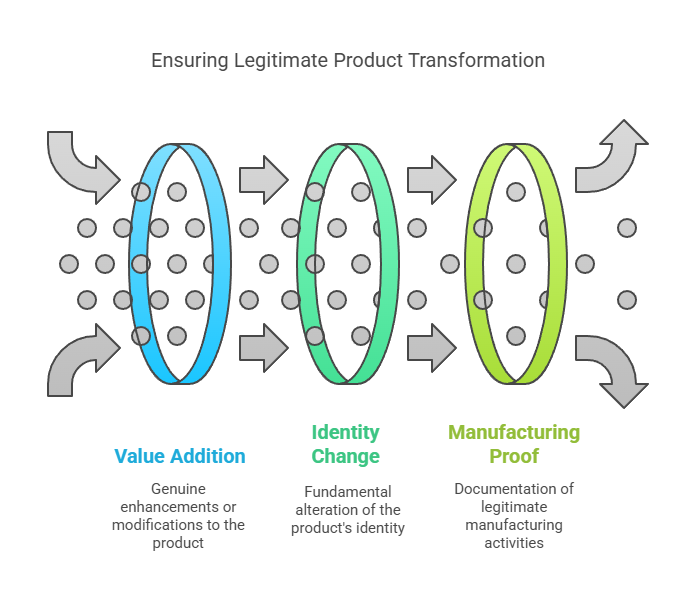

"Substantial transformation" requires genuine value addition or a fundamental change in the product’s identity in the third country. "Origin washing" (simply changing containers and paperwork) is precisely what enforcement targets. You need proof of legitimate manufacturing activities.

Legal transformation requires legitimate manufacturing activities like:

- Surface treatment of aluminum in Malaysia

- Dyeing and cutting textiles in Mexico

- Assembling electronic components into a final product in Canada

For glass products, substantial transformation might involve:

- Importing raw materials and manufacturing bottles in the third country

- Taking semi-finished components and completing significant additional processing

- Adding substantial value through specialized treatments or decorations

Documentation is critical. You must prove transformation occurred with:

- Process flows

- Bills of Materials

- Production records

- Third-country supplier invoices

- "Three levels of traceability"

Key question: Does the work performed in the third country legally change the product’s essential character according to US Customs rules?

Your next step: Have a customs attorney review your specific transformation process to determine if it meets legal requirements before proceeding.

If Transshipment is Too Risky, What Are the Alternatives?

Given these heightened risks, most importers should consider other strategies that don’t put your business in legal jeopardy.

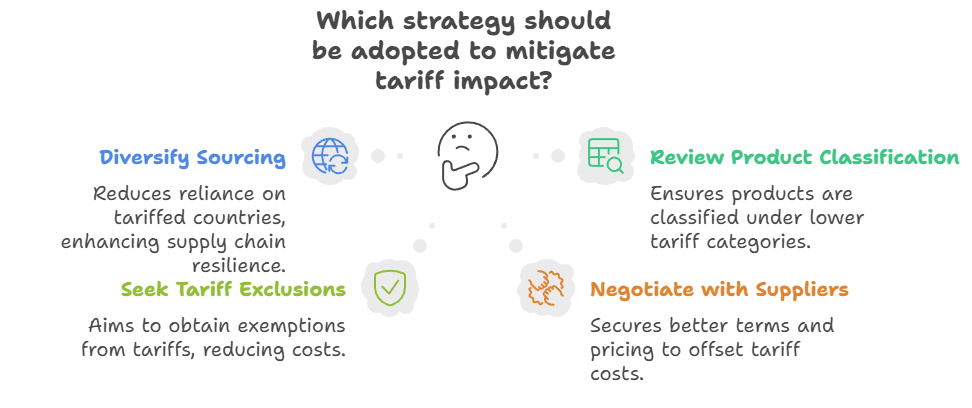

Alternative strategies include: diversifying sourcing to non-tariffed countries, reviewing product classification, seeking tariff exclusions, negotiating with suppliers, strategic pricing adjustments, and strengthening contracts with specific clauses for tariff situations.

Diversify Your Sourcing

- Explore suppliers in countries not subject to high tariffs

- Ensure production is genuinely occurring there, not just transit

- Consider leveraging RCEP and ASEAN origin rules for legitimate structuring

- Next step: Identify 2-3 alternative sourcing countries for your key products

Tariff Engineering & Classification

- Review your product’s HTS code with experts

- Determine if legitimate modifications justify a different classification with lower duties

- Example: Slight modifications to a glass container’s design could justify a different classification

- Next step: Schedule a classification review with a customs broker

Seek Exclusions/Exemptions

- Check if your specific HTS code has a temporary exclusion from Section 301 tariffs

- Monitor USTR announcements for new exclusion opportunities

- Warning: Exclusions can be temporary and subject to sudden changes

- Next step: Search the USTR Exclusions Portal

Negotiate with Suppliers

- Discuss sharing the tariff burden with Chinese suppliers

- Many manufacturers understand the situation and may offer concessions

- Consider longer-term commitments in exchange for price reductions

- Next step: Schedule negotiations with your top suppliers

Pricing Strategy Adjustments

- Analyze your margins to determine if you can absorb costs or must pass them on

- Products with strong value propositions may weather price increases better

- Consider bundling strategies to maintain value perception

- Next step: Conduct a product-by-product margin analysis

Strengthen Your Contracts

Add these critical clauses:

- Force Majeure Clause: Include "tariff increases over X%" as triggers allowing renegotiation

- Tariff Fluctuation Clause: Pre-define how unexpected tariff hikes are shared between parties

- Sanctions & Export Control Clause: Outline procedures if payment channels are affected

- Next step: Have your legal team review and update your standard contracts

Focus on Product Value

- Develop unique, high-value products where customers are less price-sensitive

- Enhance product differentiation to justify premium pricing

- Next step: Identify opportunities to increase your products’ perceived value

What’s the Smart Path Forward in This High-Tariff Environment?

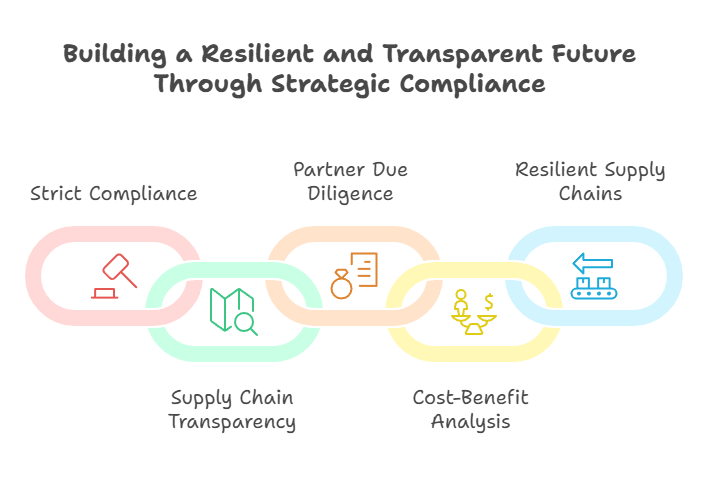

Navigating this challenging environment requires a strategic approach based on compliance and transparency rather than risky shortcuts.

The smart path forward requires: strict compliance, complete supply chain transparency, thorough partner due diligence, honest cost-benefit analysis, and building resilient supply chains based on "Logic + Compliance + Transparency" principles.

Compliance is Non-Negotiable

- The era of easy workarounds is over

- Strict adherence to US Customs law is essential

- Next step: Conduct a compliance audit of your import procedures

Transparency is Key

- Prepare to provide extensive supply chain documentation

- Invest in systems that enable robust traceability

- Consider blockchain or AI technologies for better tracking

- Next step: Evaluate your current supply chain visibility capabilities

Conduct Thorough Due Diligence

- Rigorously vet all partners and processes

- Ensure any transformation unequivocally meets legal standards

- Choose reliable, experienced logistics partners

- Next step: Create a due diligence checklist for all new suppliers

Perform Rigorous Cost-Benefit Analysis

- Weigh potential tariff savings against compliance costs and risks

- Factor in processing expenses and potential logistics delays

- Consider the reputational damage of compliance issues

- Next step: Create a decision matrix template for evaluating options

Make a Strategic Shift

- Move beyond short-term fixes to long-term solutions

- Build resilient, compliant, and diversified supply chains

- Embrace "Logic + Compliance + Transparency" as your foundation

- Next step: Develop a 2-year supply chain transition plan

I’ve seen too many businesses make hasty decisions without considering all angles, only to face devastating consequences. Taking time now to build a strategic, compliant approach will save you from potential disaster later.

Conclusion

Importing from China now involves navigating extreme tariff challenges (reaching 145%-245%) and heightened regulatory scrutiny. Traditional transshipment strategies have become exceptionally perilous. Success requires a strategic pivot toward unwavering compliance, supply chain transparency, and diversified sourcing.

Your immediate action item: Schedule a consultation with an experienced trade lawyer or customs broker this week to evaluate your specific situation and develop a tailored compliance strategy.